The smart Trick of Fast Payday Loans That Nobody is Talking About

Wiki Article

Top Guidelines Of New Payday Loans

Table of ContentsSome Known Facts About New Direct Loans.The Ultimate Guide To Fast Payday AdvanceSome Known Facts About Fast Payday Loans.The Best Guide To Fast Payday Loans

A $15 cost per $100 borrowed is rather common. A $15 fee on a $100 lending may not sound like much. Yet on a two-week lending, that exercises to an interest rate (APR) of almost 400%. Payday advance loan are one of one of the most pricey sources of non-mortgage consumer debt.

17% as of February 2022., the ordinary APR was 9. Other states have varying degrees of safeguards.

She goes to a store front payday lender as well as applies for a $300 loan this month while she figures out exactly how to address her regular monthly deficiency. To borrow $300, Amy has to pay a $45 finance cost.

Some Ideas on Payday Direct Loans You Should Know

When the loan comes due, Amy doesn't have $345. She pays a $45 charge to roll over the financing.Lots of monetary establishments will certainly also charge you a fee. But at the very least, you can quit the lending institution from taking cash you require for fundamentals, like lease or food. Note that when you make an application for on-line payday advance loan, it's typically tough to inform if you're applying with an actual lending institution or a lead generator that sends your information to lenders.

Some states call for loan providers to provide consumers a layaway plan without charging added fees. In various other states, loan providers need to enable battling borrowers to get in a layaway plan, but they're permitted to tack on added charges. Regardless of your state's regulation, it frequents a lender's passion to collaborate with you.

An additional option is to inform the lender you're so bewildered by bills that you're thinking about bankruptcy - Payday Direct Loans. Lots of loan providers are willing to endanger in this situation since they recognize it's likely they wouldn't obtain anything in insolvency court. If you're overwhelmed by payday finances or any other type of debt, credit history counseling is a great choice (https://www.zupyak.com/p/3252198/t/new-direct-loans-fundamentals-explained).

Fascination About Fast Payday Advance

Even though cash advance lending institutions call this charge a cost, it has a 391% APR (Annual Percent Rate) on a two-week finance. When the lender makes the car loan he need to inform you in writing how much he is charging for the car loan and also the APR or passion price on the lending.You can only have one cash advance financing at a time. That loan needs to be paid in complete prior to you can takeout another. When the lender makes the loan he will have to put your info right into an information base used just by other Check This Out payday lending institutions and the state company that enjoys over them.

If you still owe on a payday advance and go to another lender, that lender will inspect the data base and by law should reject you the finance. As soon as you pay off your payday funding, you can get a new one the next service day. After you obtain seven payday lendings in a row, you will need to wait two days before you can takeout a brand-new funding.

They can not even inform you that you can be arrested or put in prison. If your check doesn't clear, after that your bank will certainly charge you for "jumping" a check, and the loan provider can bring you to Civil Court to collect the cash you owe. Naturally, if a payday lending institution deposits the check, it can trigger other checks you have actually contacted jump.

The Main Principles Of Payday Direct Loans

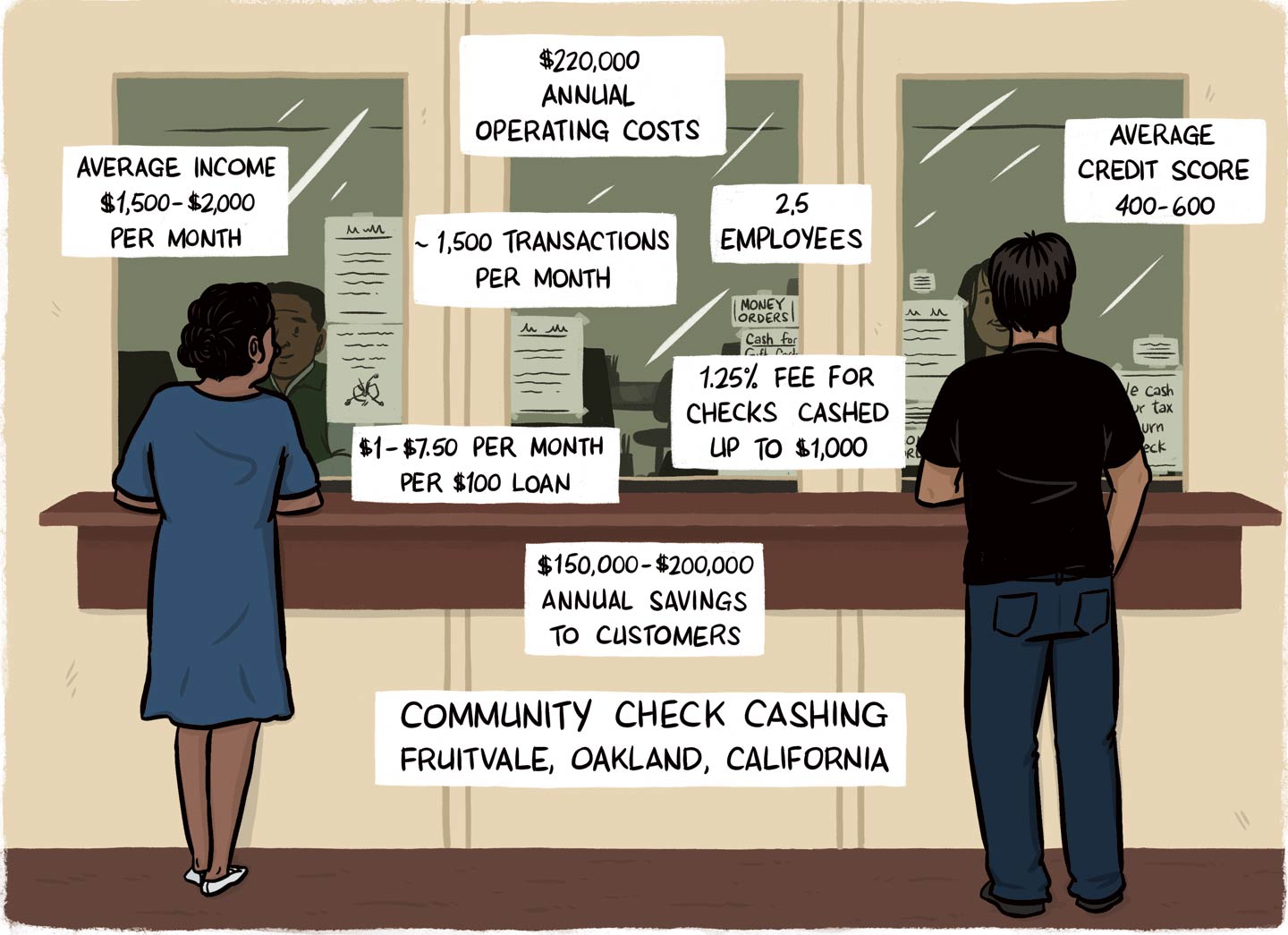

They may also accept your utility expense repayments without billing a cost. With regular checkcashing, the business does not "hold" the check before cashing it, however cashes it promptly for a cost.

If you desire to cash a preprinted paycheck or federal government look for $150 or much less, after that they can bill you $3. 00 or 2% of the check's Stated value, whichever is greater. That implies, for all checks much less than $150, they can bill you $3. 00, and if the check is for more than $150, then they'll charge you 2% of its value.

Report this wiki page